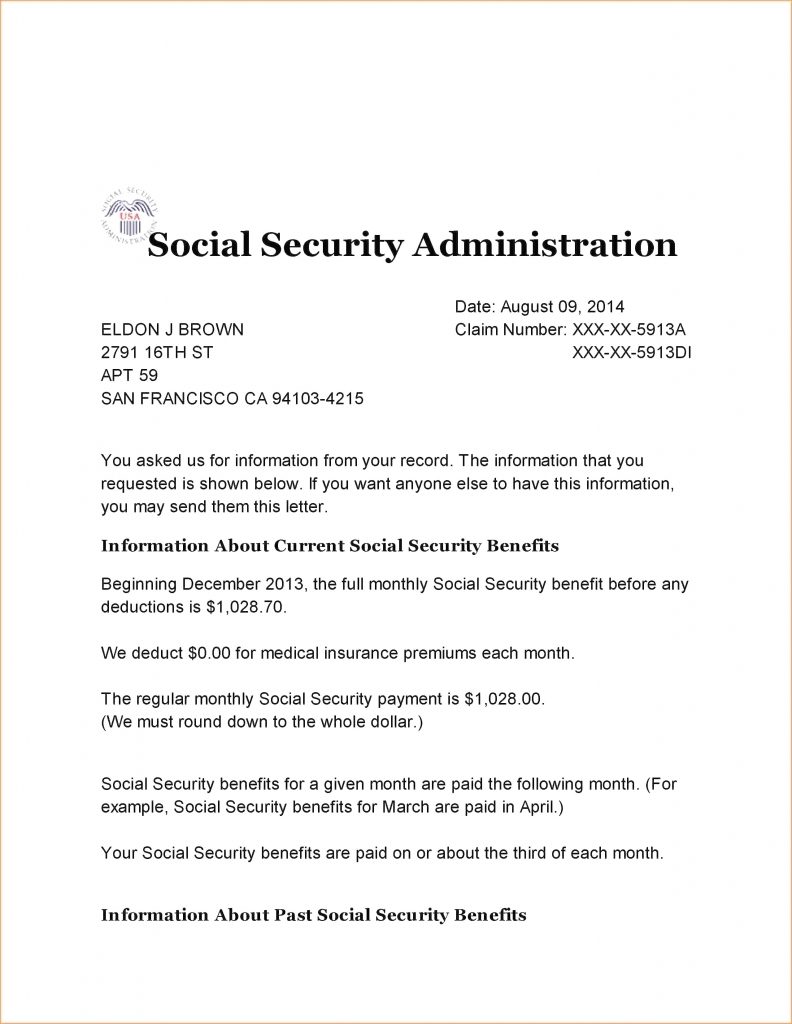

This letter will alternatively be called a budget letter, benefits letter, proof of income letter, or proof of award letter. If you have specifically applied for a disability payment, you might refer to it as a disability award letter. Keep in mind that this benefit verification letter is not the same thing as the social security statement that reflects the estimated benefit your social security account will provide you upon retirement. Keep your letter in a safe but accessible place—perhaps in the same place you keep proof of your Medicare benefits and your social security card. You may need a benefit verification letter for a number of reasons.

Perhaps you need proof of income for a loan or to verify your monthly income for housing, or state or local benefits. You may need proof of your current Medicare health insurance status. In some cases, a person may need proof of retirement status, disability status, or age. For any of these situations, a benefit verification letter will provide the proof you need.

Social security benefits include monthly retirement, survivor and disability benefits. They don't include supplemental security income payments, which aren't taxable. The net amount of social security benefits that you receive from the Social Security Administration is reported in Box 5 of Form SSA-1099, Social Security Benefit Statement, and you report that amount on line 6a of Form 1040, U.S. The taxable portion of the benefits that's included in your income and used to calculate your income tax liability depends on the total amount of your income and benefits for the taxable year.

You report the taxable portion of your social security benefits on line 6b of Form 1040 or Form 1040-SR. If your eligibility to receive social security income has been confirmed, you will generally receive your benefit verification letter one to three months after a decision is made by the social security office. That said, you may not get a letter in the mail for as long as eight months after you've applied. Even if you get one sooner than that, the quickest you should expect your Social Security Award Letter is around four months. The My Social Security online portal does more than just allow you to verify your total gross income and disability benefits from the social security administration.

Make sure you show up to all your appointments, and if you feel the need to appeal the decision about your benefits, do so as quickly as possible. Once you receive your social security award letter, keep it in a safe place and do not throw it out, in case you need to reference it for any disputes about your disability payment or retirement benefits. A person receiving disability retirement benefits who contemplates reemployment must provide KPPA with a detailed job description of the intended position, which must be completed by the employer. The medical examiners will review the position description to determine if the person may accept the new position and return to work and remain eligible to continue receipt of disability benefits.

If a person receiving disability benefits fails to disclose to KPPA any employment after retirement, KPPA may recover benefits paid to, or on behalf of, the person during the period of employment. Individuals receiving disability retirement benefits are also subject to the provisions of employment after retirement discussed in the reemployment after retirement section. Now, it's time to apply for the Social Security benefits you've earned. You no longer need to drive to a Social Security office or make an appointment with a representative.

You can apply online to start receiving your retirement benefits. The online process takes all of 15 minutes, according to the SSA. If there are questions about your application, you will be contacted by the SSA by phone or through the mail. Rather, they want to see proof of income directly from the source. This will require obtaining a copy of your social security benefits award letter (sometimes called an SSA "benefit verification letter" or social security "proof of income letter"). To create or sign in to your account to get a benefit verification letter, go toSign In Or Create An Account.

You will be able to view, print, and save the letter immediately. If you receive benefits or have a pending application, you will have the option to request to have a copy mailed to you within 10 business days. We will mail your benefit verification letter to the address we have on file. If your address is incorrect in our records and you get Social Security benefits, you should update your address through your personal my Social Security account, or by contacting us to update your address.

If you get SSI benefits, you will need to contact us to update the address. If you need proof that you get Social Security benefits, Supplemental Security Income or Medicare, you can get a benefit verification letter online by using your my Social Security account. You may use your letter for loans, housing assistance, mortgage, and for other income verification purposes. You can also use it to prove that you don't receive benefits, have applied for benefits, or that you have never received Social Security benefits or SSI.

Social Security should have sent you a disability award letter when you were approved for benefits, and that letter should have stated when you could expect your first review. If Social Security found that it was possible, though not necessarily likely, that your medical condition could improve, then your file would have been set for a three-year review. If Social Security didn't expect your condition to improve, your file would have been set for a seven-year review. Generally, the files of disability recipients over 55 receive reviews less frequently than the above timeline.

And in recent years, Social Security's lack of funding has allowed the agency to do far fewer reviews than technically required. Remember, when calling or visiting a Social Security Administration office, the income benefit verification letter goes by several names. You have to contact Social Security by phone or in person to get a copy of an original award letter. In addition to the decision letter, you will also receive a letter informing you of your monthly award amount and if applicable, your back-pay amount.

You can receive your payment via direct deposit if you have a bank account or onto a payment card which works like a debit card. You can usually expect your back pay and first monthly check to start days after the award letter. Social Security Disability Insurance SSDI provides disability benefits to blind or disabled individuals who are insured based on federal insurance contributions paid into the Social Security Trust Fund. There are several ways to obtain social security administration benefits verification. The Social Security Administration mails their benefits award letter at the end of each calendar year to inform their SSA income recipient what they can expect for the following year. If you have a copy of your social security proof of income letter, please bring it with you to your elder care attorney appointment.

The social security award letter will be delivered to the applicant, so you will not need to go out of your way to specifically request a copy. However, it is a good idea to call and check on the status of your application. In checking, remember that the phone representative will most likely not be able to tell you any details about the decision, but they may be able to confirm for you that it has been mailed out.

The good news is that you can cut that time in halfby starting your application online, at least according to the SSA. Starting your application online will allow you to fill out both the benefits application and the disability worksheet . You will still have an in-person or phone appointment which will generally last around one hour.

The South Dakota Disability Determination Services is the State Agency that makes the disability decisions for the Social Security Administration , according to federal guidelines. When SSA added protection for individuals with disabilities in 1954, the Congress wrote into the law that the disability decision had to be made by a State Agency and not by a federal office. The DDS is responsible only for the medical eligibility portion of the disability claim. SSA is responsible for the application process, any other eligibility criteria, and the calculation of benefits if awarded. In addition, SSA caseworkers are encouraged to assess the beneficiary if there is a face to face meeting at the time of application.

In some cases a person will apply for disability benefits and the caseworker will recommend that a representative payee be appointed because of limitations observed by the caseworker during the initial meeting. Also, social workers, other professionals and family members who interface with the applicant may provide evidence to the caseworker, which will support SSA's decision to appoint a representative payee. SSA rules state that someone declared incapacitated by a court must have a representative payee. Once you've established your account, it will be simple for you to come back and transact business with Social Security in the future.

For example, in addition to getting another benefit verification letter in the next year or two, you can check your benefit and payment information as well as your earnings record. You also can change your address, phone number, and direct deposit information. Although retirement benefits are available to people 62 or older, the program encourages seniors to wait until they are of full retirement age before they begin collecting retirement benefits.

Early collection of benefits results in a permanent decrease in monthly benefit amounts. The earlier you begin collecting, the fewer benefits you receive over time. Back benefits owed to an SSI recipient or SSDI benefits recipient pay will be listed on their Social Security Award Letter as well. These past-due benefits will depend on how long your application took to process and the PIA calculated by the SSA, which again varies from person to person. While SSI recipients will generally not get their back payment in one lump sum, SSDI recipients will.

You are required to have a bank account to receive these payments because the SSA only issues them through direct deposit. Monthly payment dates will be listed on the letter that let you know when your benefits will be issued. Payment dates will be different for every person, so it's a good idea to make note of when your payment date is so you can plan out paying your monthly bills, rent, or mortgage. Keep in mind that if you are applying for SSDI, it will take payments a mandatory five months to start being issued. A benefit verification letter is distinct from an award letter, the notice Social Security sends you when it has processed your application and "awarded" benefits. You have to contact Social Security by phone or in person to get a copy of your original award letter.

Unlike an award letter, a benefit verification letter can be obtained instantly online if you have a My Social Security account. Once SSDI or SSI benefits are approved, SSA will review the application to determine if the beneficiary can handle his or her cash benefit. If SSA determines that the beneficiary cannot handle the cash benefit, SSA will designate a representative payee to receive the monthly income and manage the funds on behalf of the beneficiary. SSA does not recognize powers of attorney or guardians appointed in state court. The eligibility date on your award letter will be used to determine the amount of back pay to which you are entitled. Generally speaking, should you receive an award letter, you will be entitled to Social Security Disability back pay dating to your initial claim.

Your best chance of receiving an award letter quickly, of course, lies in having an experienced Social Security attorney work with you through all stages of the Social Security Disability application process. Before submitting a Medicaid Application, it is important to know what information the Medicaid application will require. One such item is verification of gross monthly income, directly from the source . This article is focused on how to prove social security benefits only, as it is a major source of income for most older adults. Social Security Disability Insurance is sometimes confused with Supplemental Security Insurance .

SSI provides cash assistance for basic needs like clothing, food, and shelter for individuals with little to no income. Usually, these individuals are impaired, disabled, or have reached full retirement age. Most Americans over the age of 65 do collect some form of Social Security, though some will choose to defer it to a later date in order to increase the size of their monthly benefit payment. En español | An award letter is what the Social Security Administration sends out to inform an individual that a claim for benefits has been approved. Though award letters go out for any type of benefit application, the term is most commonly associated with disability claims. You cannot get a benefit verification letter online for another person, such as a spouse or child, unless the person is a beneficiary for whom you are an active representative payee.

How often you receive a CDR depends on how likely SSA thinks it is that your medical condition will improve. Examples include the completion of a vocational rehabilitation program, an SSI child's 18th birthday, when a baby turns one year old, and sometimes work-related income within the first 24 months of entitlement to SSD benefits. You must make your request to appeal within 60 days from the date you receive our letter. The claimant is allowed to submit any new evidence they deem appropriate. SSDI pays disability benefits to individuals who are insured due to contributions to the Social Security trust fund through Social Security tax on their earnings. SSDI also makes payments to certain people with disabilities who are dependents of insured individuals.

Whether or not a social security beneficiary needs a representative payee is a decision made by SSA based on the beneficiary's abilities. SSA presumes that every adult beneficiary can handle his or her social security check, unless there is evidence otherwise. SSA relies primarily on medical evidence to make this determination. An opinion letter offered by the primary care physician of the beneficiary is usually sufficient to support a decision to designate a representative payee. The physician must have examined the beneficiary within the prior year. However, the 2019 regulatory change did not apply to borrowers and grant recipients identified through the SSA match.

Supplemental Security Income helps people who are unable to earn sufficient wages on their own. It is available to adults with disabilities, children with disabilities and people 65 or older. Individuals with enough work history may be eligible to receive SSI in addition to disability or retirement benefits. The amount individuals receive varies based on their other sources of income and where they live. Disability benefits support people who cannot work because of disabilities.

As with retirement benefits, you need to have worked a certain number of years to be eligible forSocial Security Disability Insurance benefits. The amount of work you need depends on your age, and your monthly benefit amount depends on your pre-disability salary. SSDI benefits may also be available for your spouse or divorced spouse.

Retirement benefits are what typically come to mind when most people think of Social Security. Such benefits are available for people 62 or older who have worked at least 10 years. Your benefit amount will vary based on your pre-retirement salary as well as the age at which you begin collecting benefits. While it is not meant to be your only source of income, it can help youavoid debt during your retirement years. Additionally, your spouse or divorced spouse may be eligible for Social Security retirement benefits even if he or she has not paid into the program. If you disagree with any part of your letter, you need to act quickly and file an appeal.

Remember that it will take some time for your SSA benefits letter to be received. Keep in mind that this letter can only go to the address associated with your social security number, so you cannot appoint someone else to receive it. Should you require additional copies of your letter, you can request them online from the SSA via the "my Social Security" account portal. This benefit verification letter will provide some basic information about the terms of your SSDI or SSI payments.

Probably not, but this depends on the amount of your total income. Most people won't have to pay taxes on their Social Security disability benefits. Couples whose combined incomes exceed $32,000 and individuals with income exceeding $25,000 will pay income tax on a portion of their Social Security disability benefits. The IRS has an odd way of figuring out total income for this rule. The IRS uses adjusted gross income as reported on Form 1040, plus one-half of the total Social Security benefits received for the year, plus non-taxable interest. Medicare eligibility begins after you have received 24 months of Social Security disability benefits.

Note that to receive Part B of Medicare , you pay a premium that will be deducted from your Social Security disability monthly check. Your local Social Security office staff will review the non-medical portion of your application to determine the benefits for which you are eligible. They will look at your work history, your age, your income and your resources. The representative payee has important responsibilities and should seek legal advice if there are any questions or concerns regarding the beneficiary's continuing eligibility for benefits.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.