The Fedwire Wire Transfer service is the fastest way to transfer funds between business accounts and bank accounts in the USA. It is used for domestic or international transactions in the US, where the account balance is directly debited electronically and the funds are transferred to an account in real time. The SWIFT Code is a standard format for Business Identifier Codes that is used to uniquely identify banks and financial institutions globally. These codes are used when transferring money between banks, especially for international wire transfers or SEPA payments.

When 8-digits code is given, it refers to the primary office. When transferring money in Europe, you will often be asked for a SWIFT/Bic number. The American Bankers Association routing numbers are solely used for ACH transfers.

Domestic wire transfers must only be completed through local ACHs within a day. In the country of the receiving bank, international wire transfers must also clear an ACH that adds to the procedure another day. Factors like holidays at banks, time zones, weekends, and mistakes in detail may delay wire transfer. It is also essential that account numbers and bank codes be checked before a wire transfer is completed. The ABA routing numbers are useful only for ACH transfers.

If you are receiving a wire transfer, then the code will be different – fortunately, it's a simpler system with one number for domestic wire transfers and one for international wire transfers. You can receive funds to your Wells Fargo Bank account from any bank within USA using domestic wire transfer. You need to provide the following details to sender of the funds who will initiate the domestic wire transfer through his/her financial institution. A Routing Number enables Federal Reserve Banks to process Fedwire funds transfers, and to process bill payments, deposits, and other transfers via the Automated Clearing House.

Routing numbers are necessary when bank customers are paying bills by phone by using a check, when reordering checks or when a bank account holder sets up a direct deposit. Wells Fargo routing number is 9 digit unique number encryption of bank direct deposit. Routing number is necessary for the identification of wire transfers. In order to find your routing number in this case login to your online banking account and look for your routing number.

A routing number is a nine digit code, used in the United States to identify the financial institution. Routing numbers are used by Federal Reserve Banks to process Fedwire funds transfers, and ACH direct deposits, bill payments, and other automated transfers. International wire transfer is one of the fastest way to receive money from foreign countries. Banks use SWIFT network for exchanging messages required for performing international wire transfer. Usually, the receiving bank and the sending bank need to have a direct arrangement in place to start the swift transfer – this is sometimes referred to as correspondent banking. International wire transfer is a popular way to receive money from foreign countries.

All Banks use the SWIFT network for performing international wire transfers. International or domestic wire transfers both need a routing number. US banks use the same CHIPS and Fedwire systems to process international wire transfers. Instead, they send wire instructions using the Society for Worldwide Interbank Financial Telecommunications codes instead of the local bank routing number. SWIFT is a worldwide non-profit organization consisting of over 9,000 institutions. Wells Fargo routing number is unique code that follows the American Bankers Association guidelines.

The intention is to process paper checks and enable banks and credit unions to accurately send and receive funds to and from other financial institutions. Fees and limits may apply, depending on your account type and the type of wire. You will be able to review any fees and limits before completing your wire transfer in Online Banking. Latest transfer limits are also available in our Online Banking service agreement.

For Remittance Transfers, we're required by law to inform you of the exact fees you will incur for international wires, including fees from other banks. For some requests, we won't have the exact fees from other banks and therefore will not be able to process it. ACH Routing Numbers is an acronym for for Automated Clearing House routing numbers. This number is used for America electronic financial transactions. The first four digits identify the Federal Reserve district in which the bank is located and the following four numbers identify the bank. The last number is referred to as a check digit number, which is a confirmation number.

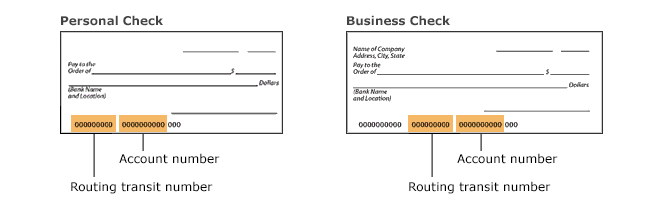

ACH Routing Numbers are used for direct deposit of payroll, federal and state tax payments, dividends, annuities, monthly payments and collections. Usually, the exact routing number is close to the bottom of the cheque, where you can identify the financial institution in which it is designed. The check number, sometimes called the ABA number or SWIFT code, can manage an account and transfer money from one bank account to another. Wells Fargo routing number is a unique nine-digit number usually at the bottom of a check. It identifies the financial institution on which it was drawn or printed.

Routing number also known as American Bankers Association number, routing transit number or SWIFT code is used to maintain an account and to transfer money from one account to another. Wells Fargo Bank Routing Numbers lists routing numbers for Wells Fargo's checking and savings accounts. A Bank ABA "routing numbers" or "check routing number" is a 9 digit code used in the United States to ID the institution from which money is drawn.

Routing numbers are also known as "routing transit numbers" . If you are looking for Wells fargo bank routing number for wire transfer, then you are at right place. Here, we are going to full list of Wells fargo bank routing number with address. Domestic wire transfers in the US, however, communicate transaction instructions through CHIPS or Fedwire networks. On the other hand, international wire transfers use SWIFT, a network of more than 10,000 banks and financial institutions across 200 countries. The routing number for domestic and international wire transfers for Wells Fargo are the same across all states.

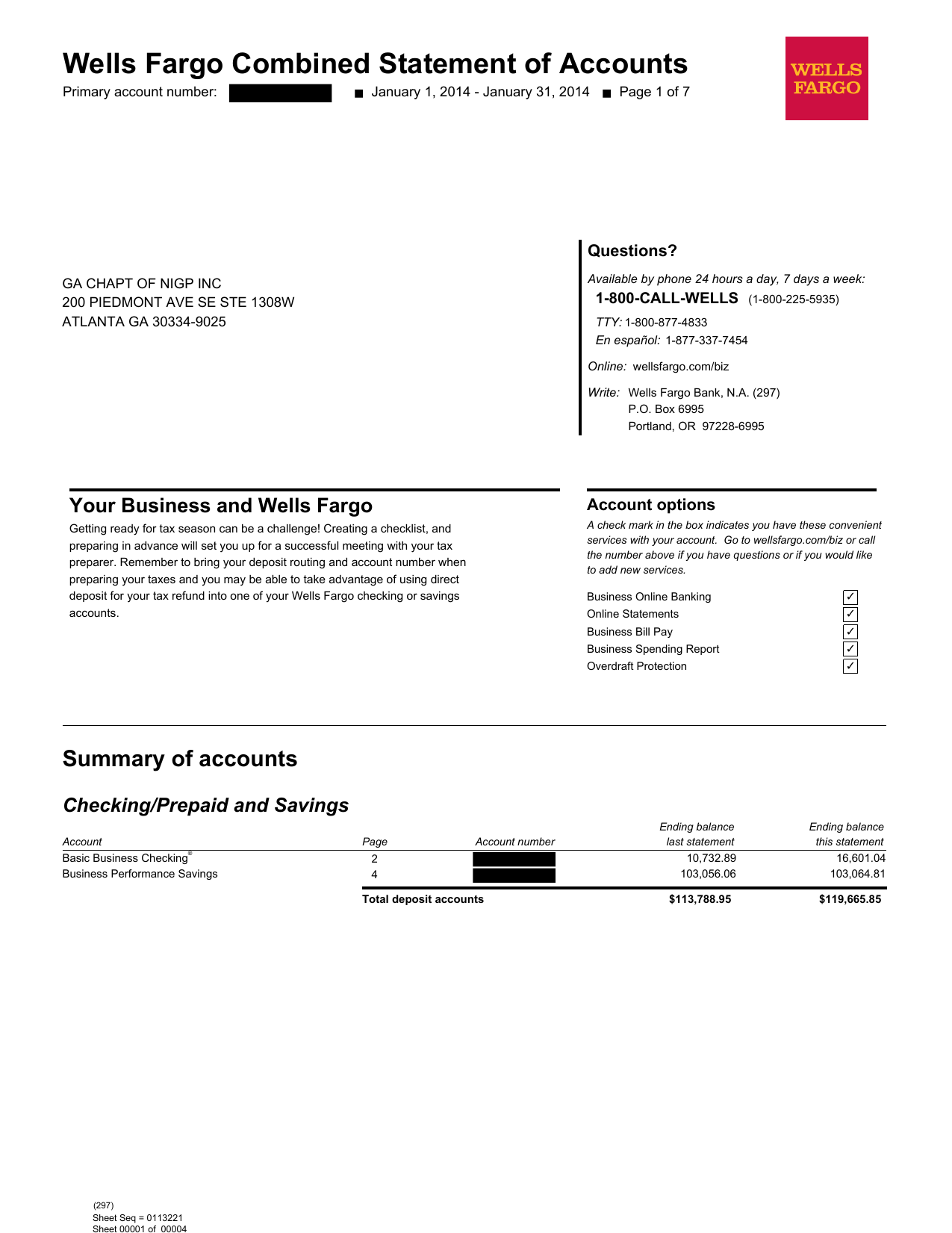

The checking and saving account routing number and the ACH routing number for Wells Fargo varies state by state, you can find these in the table above. Routing numbers are also known as "Check Routing Numbers", "ABA Numbers", or "Routing Transit Numbers" . The ABA routing number is a 9-digit identification number assigned to financial institutions by The American Bankers Association . The number determines the financial institution upon which a payment is drawn. Each routing number is unique to a particular bank, large banks may have more than one routing number for different states.

Routing numbers may differ depending on where your account was opened and the type of transaction made. An ABA routing number, also known as a bank routing number that identifies the perticular financial institution or banks branch in the U.S. ABA routing no is a nine digits numarical number developed by American Bankers Association in 1910. An ABA Routing Number will only be issued to a federal or state chartered financial institution which is eligible to maintain an account at a Federal Reserve Bank.

Incoming and outgoing international wire transfer costs depend on the provider, destination, transaction amount, and the mode of sending money. They can also cost more if you choose to use Wells Fargo's foreign currency exchange service. Now you'll see the routing number for direct deposits, electronic payments, and domestic wire transfers. When sending wire transfers to countries that have IBAN numbers, we recommend including those numbers in your wire transfer documentation.

According to the European Directive, only the account-keeping bank may calculate the IBAN / check digits. To obtain the IBAN numbers of another bank, please visit that banks website or contact them directly to obtain that information. Wire transfer is the fastest mode of receiving money in your Wells Fargo Bank account.

You can receive money from within USA or from a foreign country . The transaction is initiated by the sender through a financial institution, however and need to provide your banking details to the sender for successful transfer of money. You can receive funds to your Wells Fargo account from any bank within USA by using a domestic wire transfer. Use these details to receive an international wire transfer in your Wells Fargo account. A routing number is a nine-digit numeric code printed on the bottom of checks that is used to facilitate the electronic routing of funds from one bank account to another.

It's also referred to as RTN, routing transit number or bank routing number. ABA routing numbers, or routing transit numbers, are nine-digit codes you can find on the bottom of checks and are used for ACH and wire transfers. Branch code is the first 3 digits and the following 7-9 digits are account number. The best bank accounts for kids include features that help you teach them about money management, earning interest, and more. Here are the details regarding some of the best checking and savings accounts for getting your kids on the path to great money management in adulthood. A routing number, also called the ABA routing transit number , is a nine-digit code that indicates the financial institution you bank at.

They are unique to each bank and allow the accurate transferring of money between financial institutions. Wells Fargo Routing Number is a necessary code used when doing money transfers. If you want to send money, you need to use your branch details usually recognizable by the routing transit number. Using the correct routing number before you initiate a money transfer is vital. One of the most successful American Multinational banking and a financial holding company is Wells Fargo & Company.

Founded in 1852, Wells Fargo offers numerous services and functions to facilitate their clients. The Wells Fargo routing number is one of the most crucial 9-digit code that helps expedite seamless wire transfer service. There are several routing numbers for Wells Fargo Bank, National Association reported in our bank database. On checks, bank routing numbers are a multi digit key that comes right before your bank account number. Why do people hang their christmas trees upside down If you have a checking account with Wells Fargo then at some point you will need to know what your routing number is. Reedley, California There are several routing numbers for Wells Fargo Bank, National Association reported in our bank database.

Yes, someone with your account information can wire funds directly to your Bank of America account. You will need to provide your account number and wire transfer routing number. For incoming international wires, you will also need to provide the appropriate SWIFT Code. International wire transfers initiated by a consumer primarily for personal, family or household purposes may be cancelled within 30 minutes of confirmation for a full refund, including any fees.

We'll refund your money within 3 business days of your request to cancel a transfer as long as the funds have not already been picked up or deposited into the recipient's account. You can Sign in to Online Banking and select the tab to send money to your own account, someone else or a business. You can also make an appointment to send a wire transfer at a local Bank of America financial center. Wire transfers are among the most prevalent methods of financial transfer between local and international banks.

Do people or companies interested in making such a transaction may inquire about the difference between domestic and international wire transfers? Routing numbers differ for checking and savings accounts, prepaid cards, IRAs, lines of credit, and wire transfers. All banks usually have separate routing numbers for each of the states in the US. A SWIFT code is used instead of a routing number for international wire transfers.

This is an international wire transfer initiated by a consumer for personal, family, or household purposes. You'll likely need your Wells Fargo routing number when managing your finances. Keep it handy should you need to set up a direct deposit, automatic payment, or wire transfer. Likewise, credit cards do not have routing numbers since they are not directly linked to any bank account. Although your debit card is associated with a bank account, you do not use a routing number for debit card transactions.

Routing numbers are only used for transfers directly between bank accounts. Using a Wells Fargo account in the US to send or receive a domestic or international wire transfer? Make sure your payment arrives by using the right routing number. The American Bankers Association usually manage the official routing number registrar. You need to verify the Wells Fargo routing number before you start any transaction.

You must know your state name and your account type to get your Wells Fargo routing number. It is essential to have the correct routing number for the transaction you want to make because the routing number on your checks differ from the routing number you would use for a wire transfer. As you earn income online, you will need to connect your savings and checking accounts to your various income sources.

I can't tell you how many times I've had to input my routing number. It shouldn't be this hard to maintain your bank accounts and personal finances. WELLS FARGO BANK NA routing numbers have a nine-digit numeric code printed on the bottom of checks which is used for electronic routing of funds from one bank account to another. There are 20 active routing numbers for WELLS FARGO BANK NA.

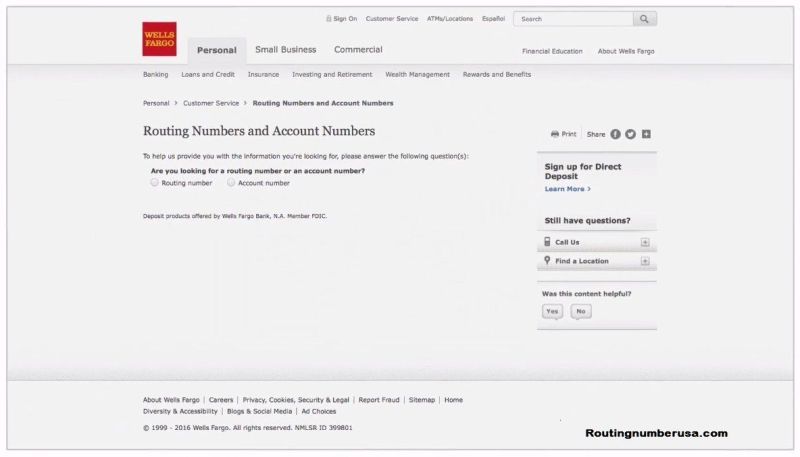

Wells Fargo routing number is a nine-digit numeric code printed on the bottom of checks that is used to facilitate the electronic routing of funds from one bank account to another. Know your Wells Fargo Routing Number on RoutingNumberUSA.com. Find ABA routing transit numbers or RTNs for different accounts in all states of the United States & SWIFT codes. Here you will find all the details regarding this bank like all branches and ATMS locations in America, heads names and addresses, etc.

For Remittance Transfers, we're now required by law to inform you of the exact fees you will incur for international wires, including fees from other banks. We recommend using services like TransferWise for getting best conversion rates with lower wire transfer fees. Bank of America routing numbers are 9-digit numbers assigned by the ABA.

Routing numbers for Bank of America vary by state and transaction type. The routing number is based on the bank location where your account was opened. You can find the routing number quickly on the bottom and left side of your checks. Wells Fargo Routing Number What is my routing number for Wells Fargo?